All RETNA Is Saying Is Give Rent A Chance

Leveraging Capital Markets for Affordable Rental Housing in Developing Markets

June 8, 2016

5 negocios que están innovando en el sector inmobiliario

January 25, 2017All RETNA Is Saying Is Give Rent A Chance

Rodrigo Barrera of RETNA Ingenieria Inmobiliaria of Mexico starts his slide deck with this play on one of John Lennon’s most famous lyrics. His is one of the best pitch decks in housing that I’ve ever seen. Rodrigo and I are speaking at the World Bank’s 7th Global Housing Finance Conference in Washington, DC at the end of May.

Rodrigo insists repeatedly: Homeownership is overrated. This reality drives the business model of RETNA, a Mexican real estate investment fund (a FIBRA or a REIT in the US) set up to invest in and own rental housing. The founder and managing principal of RETNA, Rodrigo comes to the venture with 20 years of experience in corporate finance, risk management, capital markets, corporate strategic investments and data science start-ups while getting his MBA at Stanford.

Rental housing is a big gap on the housing product ladder in most developing markets. It represents an important unfilled need for those not creditworthy enough for a mortgage or who simply can’t or don’t want to buy a home. Because RETNA is a real estate investment fund, RETNA holds out the promise of a market-driven solution. This is a solution that developed capital markets have already adopted at scale.

RETNA and Rodrigo have a lot riding on the economic principle and the apparent need. RETNA is a pilot with a small but growing initial corpus: It owns a little over USD 5 million in 62 rental units in Mexico City. Club de Rentas is a platform within RETNA that aggregates owners of housing, manages their rental units professionally and pays the owners a return. The Club de Rentas has 80 units within its membership that also generate cash flow.

DSC: First of all, how do you explain the economics of rental when policymakers are so focused on encouraging homeownership, equity, asset-building, etc?

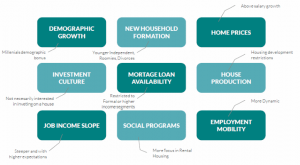

Rodrigo Barrera, RETNA: Mexico’s demographics and socioeconomics are very favorable for rental because we have a young population with increasing rates of household formation and house prices increasing faster than incomes.

Homeownership also has friction costs that aren’t well understood. Entry and exit are expensive and challenging. If you end up in a home or in a place that you don’t like or your job changes, then you might leave the house sooner than you expected. In Mexico, the average breakeven ownership period for a house to make ownership financially equivalent to renting is a little less than 20 years, depending on assumptions. That’s a long time for a geographically, demographically and socioeconomically dynamic population like Mexico’s.

RETNA is the first FIBRA to recognize that rental housing is a big opportunity. Economically, it makes more sense to postpone the decision to buy in most circumstances. If you rent, you can lower the risk that you make a bad decision about the purchase. It makes sense if the household’s circumstances may change. id=””]

DSC: In a lot of emerging markets, institutionally managed rental housing is only in high end segments, like executive apartments. Is that how it is in Mexico? Who is renting apartments?

RB: That’s one of the interesting things about Mexico. In most developed real estate markets, the rental market peaks with young people early in their professional career and household formation then it drops throughout the rest of their lives. Also, there is usually higher demand from lower and moderate income segments.

In Mexico, demand for rental housing among higher income groups is saturated already. In fact, there’s oversupply. It’s not a good market. There’s a drop among middle income families and, most interesting, there’s very little demand from low income households. This is very unusual in developed markets. In Mexico, we have no rental subsidy, so low income households don’t have formal rental as an option.

Then, government housing subsidies to moderate income households make them indifferent between renting and buying. So a low income homebuyer can walk away from the house without much penalty because they haven’t built equity. And that’s exactly what Mexicans with subsidized mortgages did in the hundreds of thousands. It caused a big dislocation in our housing markets.

DSC: Emerging markets REITs normally invest in office buildings or shopping malls, assets that generate regular cash flows. In developed markets, multifamily REITs regularly develop, own and manage housing, substantial proportions of which are affordable or workforce housing. Why is Mexico still early to this?

RB: There are lots of reasons why it’s not yet the case that this exists in Mexico. There is definitely a cultural interest in owning a house. We have an extensive system of subsidized mortgages for low cost homes for salaried and moderate income informal sector workers, as I mentioned.

However, the major bottleneck is well-located urban land and urban planning. To make this work, we need a more established supply of multifamily housing. Mexican cities are not zoned for higher density urban housing, so developers are also not able to build for rental. When zoning in the cities only allows low density, then the cost of land dictates only high yield uses. That normally eliminates middle income or more affordable housing as a use.

Mexico City has low home rental penetration compared with other major markets. In Bogota, New York and London, 40%-50% of housing is leased compared with Mexico City, where only 20% of housing is rental. Beyond that, only 1% of Mexico’s rental housing is institutionally owned and managed compared with 33% in the US. Those that do rent their houses or apartments are informal landlords who pay no taxes but do have to deal with the hassles of being landlords.

DSC: How are you going to address this issue of supply given the land situation?

RB: First, we will get some enabling code and planning. Mexico City’s charter is going to change to incentivize land reuse to build higher for multi-family rental. Second, we are going to use the poligonos de actuacion mechanism. With that policy, the city creates zones for development where it’s possible to execute several of these projects in one place to begin densifying the city. Then within a given zone we will build several buildings, as well as a central community services hub.

We can help owners rent out their places. They benefit from not having the hassle of managing their own places. They actually make more money with us because we manage them professionally, so they get more rent. They pay their taxes and they get more net cash flow. We’re trying to get our IRS to sponsor this because of positive fiscal impact on taxes.

As an example, right now “empty nesters” could earn higher yield on the property they own by shifting their low-yielding home equity into the RETNA vehicle. In return, they would earn higher yield and current income on a diversified portfolio of urban rental properties.

DSC: Given the size of the organization and the challenge of acquiring apartments, are the administrative costs of acquisitions and management a big bottleneck for RETNA?

RB: It’s true that right now, we can only acquire, for example, blocks of 10 apartments, rather than hundreds of apartments. That’s a pain from an administrative perspective. But once you get to a certain scale, variable costs become fixed costs in that you have systems. That way, the additional cost of another apartment is negligible. But yes, we have to get to scale to achieve those benefits.

This is one reason why we started the Club de Rentas. There are already thousands of informal landlords. For most of them, it’s a headache to manage these apartments, and they’re not making the most of those assets. Institutionalizing the management of those assets will add to the pool of properties generating cash flows for the REIT. Landlords will make better returns. Public authorities will collect currently unpaid taxes as well.id=””]

DSC: You said something crazy things about change and innovation coming from rental housing and capital markets in the panel discussion. That kind of language is unusual in real estate in general.

RB: Yes, it’s a conservative business. There are three things we should be thinking about to motivate developing multifamily housing REITs in Mexico. First, we should see REITs and rental pools as agents of change. Landlords in RETNA can unlock their equity and monetize their assets much more efficiently if their real estate is institutionally owned and managed. This will help fill a big gap in the housing ladder.

Second, we can make it possible for renters to accrue equity also through some creative thinking and innovative structuring. We would separate the idea of home ownership and real estate ownership. With lease-to-own options or even giving renters a way to earn equity in the REIT, then they can also be incentivized to act like owners.

Finally, we need to foster the institutionalization of rental housing to achieve a long “Santa’s List” of urban, fiscal and investment benefits. My wish list includes regulation for land reuse, development rights, the right tax frameworks, long-term financing for rental housing projects, fast track permits and better rules on occupancy, delinquency and eviction.

DSC: How deep into the affordability ladder can you get with RETNA and Club de Rentas?

RB: Right now, it has to be middle income housing. That’s our sweet spot right now given the state of policy and land. If you have lower income, you are entitled to a subsidized mortgage, and that market continues to grow. If you analyze incomes, socioeconomic mobility and household stability, you find that the economic benefits of renting only are higher for people early in their career or family or for people whose professional lives and income are not as stable.

The potential to buy increases if your income expectations are rising with your household stability. In that case, it makes even more sense to rent with an option to buy. Buying to accrue equity mostly makes sense for people with stable careers and families with rising incomes.

DSC: In emerging markets, the ability to evict is constantly raised as a barrier to rentals.

RB: It’s true that it can be complicated to evict, but you do everything you can to avoid that outcome. First of all, you can minimize that risk with good origination. You have to treat tenants as cash flows. You want quality cash flows. We have the means of figuring out good tenants generally.

We have another helpful strategy with the Club de Rentas: we directly deduct rent from the payroll of tenants who qualify for the governent program, Arrendavit, which was established to promote rental housing and leasing-to-own. So this helps with minimizing risk on cash flows while the government program makes it easier for people who move for their job.

Then, yes, sometimes you have to evict, but there are processes. You have lawyers. Maybe it takes a while on occasion, but there’s no need to pursue extra-judicial steps as some believe. We do certainly have to improve on this through policy and our operations.